Browsing the Complex Globe of Company Formation: Insights and Techniques

Embarking on the journey of developing a company can be a daunting task, particularly in a landscape where policies are regularly evolving, and the risks are high. As entrepreneurs laid out to navigate the detailed world of business development, it becomes crucial to outfit oneself with a deep understanding of the elaborate subtleties that specify the procedure. From selecting the most ideal organization structure to ensuring rigid lawful compliance and developing efficient tax obligation planning approaches, the path to creating a successful company entity is filled with intricacies. Nevertheless, by untangling the layers of intricacies and leveraging insightful techniques, entrepreneurs can lead the way for a strong structure that establishes the phase for future growth and sustainability.

Service Framework Choice

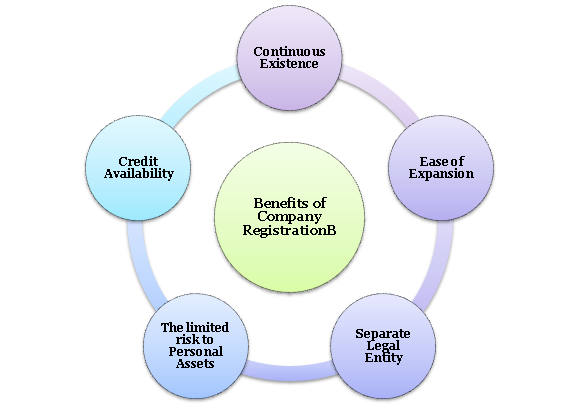

In the realm of firm development, the important decision of choosing the proper organization framework lays the structure for the entity's legal and functional structure. The choice of organization framework considerably impacts numerous elements of the company, including taxes, liability, monitoring control, and compliance requirements. Business owners should thoroughly evaluate the readily available options, such as single proprietorship, partnership, limited responsibility business (LLC), or firm, to figure out the most appropriate structure that lines up with their business objectives and circumstances.

One usual framework is the single proprietorship, where the owner and the organization are thought about the exact same lawful entity. Recognizing the subtleties of each organization framework is essential in making an educated choice that sets a solid groundwork for the company's future success.

Lawful Compliance Fundamentals

With the foundation of an ideal company framework in place, making certain legal compliance essentials becomes paramount for guarding the entity's procedures and maintaining regulatory adherence. Legal compliance is vital for business to operate within the boundaries of the legislation and prevent legal concerns or prospective penalties. Secret legal conformity essentials consist of acquiring the necessary permits and licenses, adhering to tax obligation regulations, executing correct information security actions, and abiding with labor regulations. Failing to follow legal needs can lead to penalties, legal actions, reputational damage, or even the closure of the business.

To ensure legal conformity, companies need to on a regular basis assess and upgrade their treatments and policies to mirror any changes in policies. Seeking legal counsel or compliance experts can additionally aid business browse the intricate legal landscape and remain up to date with evolving policies.

Tax Planning Considerations

Furthermore, tax preparation must incorporate strategies to capitalize on offered tax credit histories, deductions, and rewards. By strategically timing income and expenditures, services can possibly lower their taxable revenue and overall tax problem. It is likewise essential to stay notified about changes in tax regulations that might affect the service, adapting approaches accordingly to continue to be tax-efficient.

Additionally, worldwide tax preparation factors to consider might arise for organizations running throughout boundaries, involving intricacies such as transfer prices and international tax obligation credits - company formation. Seeking assistance from tax specialists can assist navigate these complexities and develop a thorough tax plan customized to the business's requirements

Strategic Financial Administration

Efficient economic management involves a comprehensive approach to looking after a business's monetary resources, financial investments, and overall economic health. By producing thorough spending plans that line up with the company's objectives and goals, services can allocate sources efficiently and track performance versus economic targets.

Checking money inflows and blog here discharges, managing operating funding successfully, and guaranteeing sufficient liquidity are crucial for the daily procedures and long-lasting feasibility of a firm. By determining economic risks such as market volatility, credit scores risks, or regulatory changes, business can proactively implement steps to safeguard their economic stability.

Additionally, economic coverage and evaluation play an essential duty in critical decision-making. By producing accurate economic records and performing extensive evaluation, services can gain beneficial understandings right into their financial efficiency, recognize locations for enhancement, and make notified critical choices that drive sustainable development and success.

Growth and Development Techniques

To drive a company towards increased market visibility and productivity, calculated growth and expansion strategies should be diligently developed and applied. One efficient technique for development is diversity, where a business goes into brand-new markets or offers brand-new products or look at this web-site services to utilize and decrease threats on emerging opportunities. It is essential for business to carry out extensive market research study, monetary evaluation, and danger evaluations prior to beginning on any kind of development technique to ensure sustainability and success.

Conclusion

Finally, go to the website navigating the intricacies of firm formation requires cautious consideration of organization structure, legal conformity, tax obligation preparation, monetary administration, and growth strategies. By purposefully choosing the ideal service framework, ensuring lawful conformity, intending for tax obligations, managing finances properly, and carrying out development approaches, companies can establish themselves up for success in the affordable business environment. It is very important for businesses to approach firm development with a tactical and detailed way of thinking to accomplish lasting success.

In the realm of company formation, the vital decision of picking the proper service structure lays the foundation for the entity's operational and legal structure. Entrepreneurs need to carefully evaluate the readily available choices, such as sole proprietorship, partnership, limited responsibility company (LLC), or company, to establish the most suitable structure that aligns with their company objectives and circumstances.

By developing comprehensive budgets that straighten with the firm's objectives and objectives, organizations can designate sources efficiently and track efficiency against financial targets.

In verdict, navigating the intricacies of business formation needs cautious consideration of business framework, legal compliance, tax planning, economic monitoring, and development strategies. By strategically picking the ideal organization structure, guaranteeing legal conformity, intending for taxes, taking care of funds effectively, and carrying out growth techniques, companies can set themselves up for success in the affordable organization environment.